What’s a home appraisal? (2024)

5 years ago “home appraisal”, (aka “bank appraisal”) wasn’t a topic that came up very often. With the volatility in home prices in Guelph over the past few months, we hear more and more about...

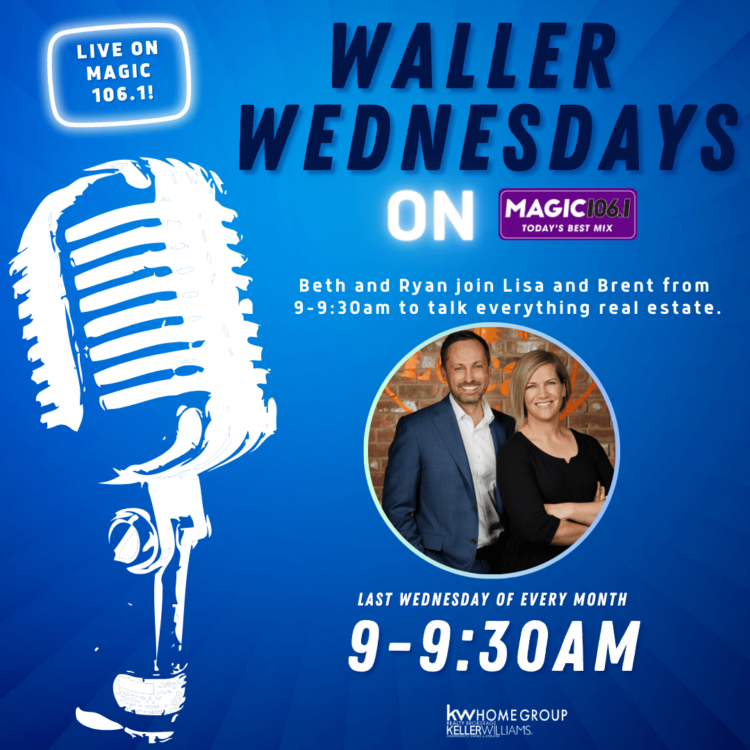

Beth and Ryan Waller are top Guelph Real Estate Agents who help more buyers and sellers of homes in Guelph than almost anyone else.

Guelph real estate is our focus and our approach is simple: we don’t believe in high pressure sales or tactics. We do believe in being informative and providing free information on the Guelph real estate market. This can be found in some of the Guelph real estate initiatives below.

As real estate agents in Guelph, you can find us providing all sorts of information in Guelph real estate through frequent updates on a variety of channels. Some of these include:

Guelph realtors and Guelph real estate agents and proud members of KW Home Group Realty