Here’s the video version of this article:

It’s that time of year again, where look back on 2025 while providing our 2026 Guelph real estate predictions!

2025 was a much tamer year than most had predicted. In fact, it’s probably pretty safe to say it was a boring year over all. And, boring isn’t necessarily bad.

A year ago, many economists were anticipating that spring 2025 was going to be a launch upwards of real estate prices. It feels like every year around October, sellers who were on the fence about selling, decide that they’re done for the year. They’ll come back next Spring in hopes that the market will be better.

What’s the shortened summary version of 2025 Guelph real estate?

Really, it has been a lot like 2024. A few key notes from our ongoing blog on the Guelph real estate market (updated bi-weekly, give it a bookmark!) is that:

Sales in $ are down roughly 4% in 2025 vs 2024

Unit sales (# of houses sold) are down roughly 4% in 2025

Average price is neutral in 2025

The Government of Canada reduced interest rates by .25 four times (4 x .25= 1% in total) for 2025. This is good for those with a variable rate mortgage or HELOC. However, individually it hasn’t really seemed to be a catalyst to higher prices. Remember, these cuts are not all good news. The cuts are made because the Government is trying to stimulate a slowing economy.

Will the Guelph real estate market be better in Spring 2026?

We get asked almost daily “how is the market?” and the answer to that will probably bore you to death. Because there is no simple answer.

Here’s the thing about real estate: “Better” is very subjective, because there are two sides to every transaction. You could say “Better” for sellers means higher prices. Or, “Better” for buyers means lower prices. “Better” can mean a lot of things for a lot of people. However, economists, mortgage brokers and real estate agents tend to imply that “better” means higher prices.

But that’s not the reality.

2026 Guelph real estate market predictions

Of course, making our 2026 Guelph real estate predictions on a full year worth of real estate is a big task. A year is a long time!

Our team watches data on a weekly basis, so we start to see trends in real time. It was what allowed us to predict the rise in bungalows for sale in Guelph in the older neighbourhoods as downsizers and investors moved into Guelph. It also allowed us to see a boom in the higher priced homes in Guelph before it hit.

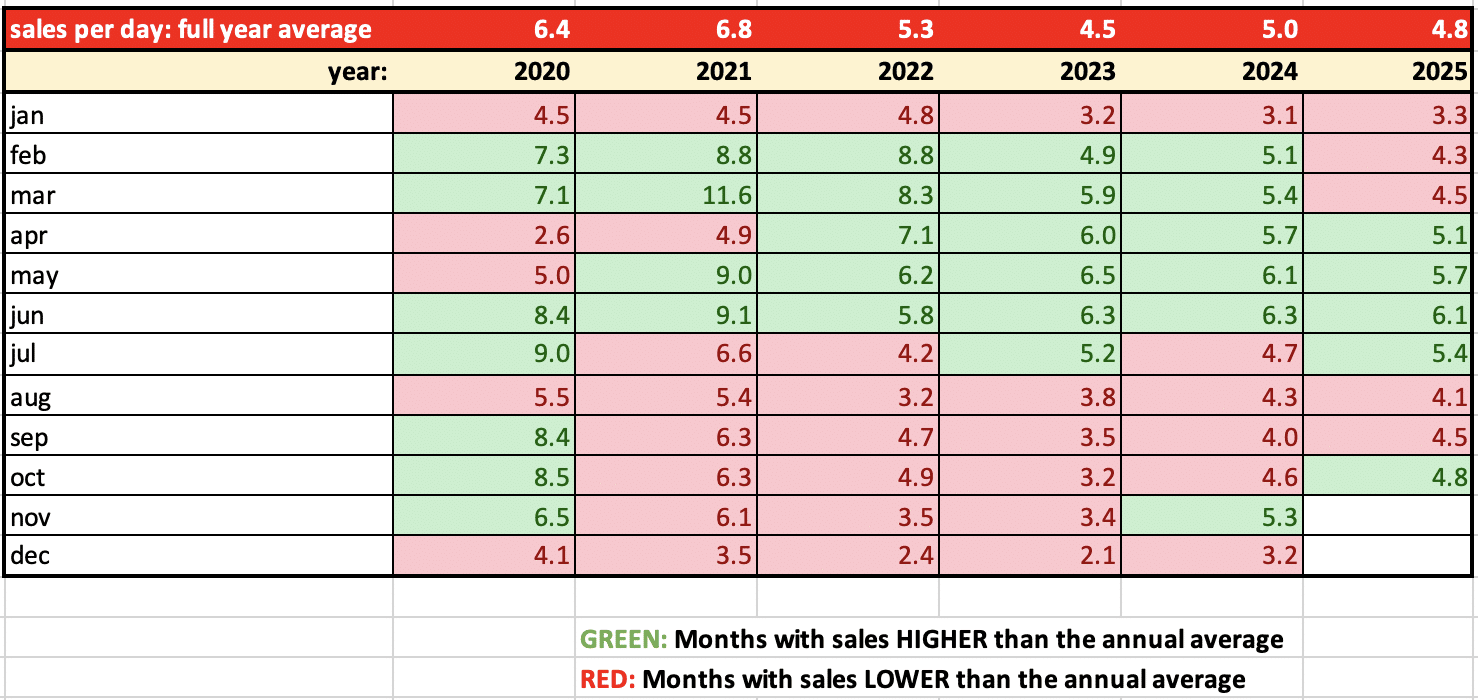

But first, let’s start with seasonality trends

Every year, there are some pretty safe bets: January and December will be lower than the annual average. April, May and June will be higher than the annual average. And, with the exception of 2025 (tariff talk spooked the market), February and March are usually the start of the spring market.

For 2026, we anticipate a year similar to 2023, where all the predictable months fall into place: that is, Feb- June are above average. The remaining months are below.

This would mean an improvement to 2025 in terms of units sold (see below)

1. 2026 Guelph real estate average price: a slight decline of -1% to -3%

We’ve read a lot of info and crunched some data prior to coming to this conclusion. Some of the information we read predicted 2026 to be the next gold rush of prices. We’re not sure how that’s possible. The reality is, prices don’t just rise or fall for no reason at all. In fact, some of the predictions we see are completely baseless.

For extreme rising or falling of prices, there needs to be an imbalance. This means either extreme low supply for prices to rise quickly, or extreme low demand for prices to fall quickly. We’re currently in a market of over 4 months of inventory and we don’t see that changing anytime soon.

It’s worth noting in our prediction that “average price” is simply that- the average. So, if there were a glut of lower priced homes to sell, it could bring the average price down 20%. This doesn’t mean every house in Guelph has declined 20%, it could mean the mix of sold houses has changed. If we do sell more higher priced homes selling (see below), it could appear that the average is rising.

Average price in Guelph real estate Jan 2020- Oct 2025:

Why do we see the average price declining in Guelph real estate?

The Canadian economy is not great. In particular, in southwestern Ontario (Hamilton/Guelph/ KW/ Brantford) is feeling the impact of US tariffs and higher unemployment. According to Statistics Canada, Guelph unemployment is approaching levels not seen since the pandemic. These are led by declines in manufacturing and construction. There are very few new homes being built in the Guelph area.

To offset this, the Government of Canada has reduced the prime rate 4 times in 2025. Each of these were .25 BPS for a total of 1% in 2025. With the rate now sitting at 2.25%, it means if you have a $500,000 mortgage you are saving roughly $400/month versus one year ago. The intent of these reductions is to stimulate the economy in tough times. Of course, the Government always tries to get ahead of trouble, which could indicate a rough period ahead.

But it’s not all gloom

Lower rates mean that some segments of the market may reconsider. As an example, first time buyers may find it’s the right time to finally make a move. This is part of the reason we’re expecting an average price decline. First time buyers entering the market at lower priced homes.

The other main reason is that as long as we have ample inventory, buyers have choice. When buyers have choice, they can negotiate prices. And, we don’t see a huge rationale for inventory to decrease into 2026. For that to happen, either:

- Buyers have to spring into the market. They start buying up properties at levels that would decrease inventory by 50%, and/ or

- Sellers have to start pulling their houses from the market, creating a lot less selection and inventory

We actually see the opposite happening: buyers will return, but cautiously. Sellers will be equal to, or greater in terms of inventory in 2026. This is a recipe for a slight decline of -1 to -3%.

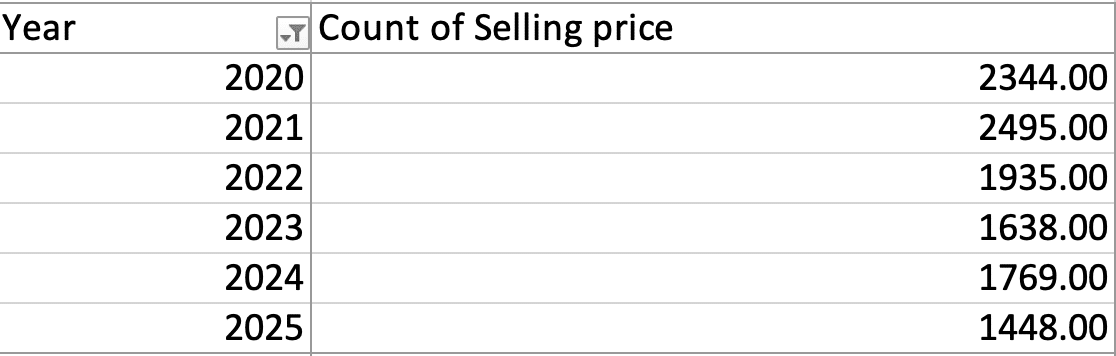

# of houses to sell in Guelph will increase 3-5%

For the full year of 2025, it will be the lowest # of houses to sell in 6 years. However, we do see a cautious return and an increase in units to sell in 2026 by 3-5% for a variety of reasons.

This is due to a few reasons, mainly further declining interest rates. There is also some renewed interest in the $700K and less segment. As mentioned, we see first time buyers entering the market that will prop up the lower end of pricing.

But we also see an increase from a few other segments that may not have been as prevelant in 2022-2024:

Investors jumping ship

Remember the rush of 2020- 2022? Particularly in the GTA, many investors/ buyers were purchasing condos at rates that we’ve never seen. Suddenly, there was a glut of inventory on the market. As a result, the municipal Governments starting creating rules around short term rentals and vacancies. Landlord/ tenant rules made headlines.

Many investors were stuck with empty rental properties that they weren’t sure what to do with. Lastly, rent prices started to decline from the peak as tenants had more options than ever before. These investors have a few choices which include not renting at all. Or, waiting for a better market, or selling at a loss.

In Guelph, these typically happen in condos. It’s part of the reason we’ve seen a large rise in inventory and falling prices.

Mortgage renewals

Remember your friend who got an interest rate at 2% in 2021? Well, it’s coming up for renewal in 2026 and it’s likely close to 4% now. Many people who were stretched to buy a house in 2020/2021 are now in (unfortunately) a tough situation. They have some tough decisions to make. Many are either selling their homes at a loss vs the purchase. Or, downsizing to something more affordable or moving to the rental market.

In some extreme cases, we begin to notice more power of sale listings. This is a situation where the seller can no longer afford the mortgage payments and ignores the bank. The lender then forces the house for sale in order to get their money back.

Here’s a chart from Ratehub. It will give you a visual of just how low rates went in 2021 and how quickly they rose:

$1M+ segment sees strength

One of the interesting things we noticed was that pricing of houses in the $1M mark seem to holding strong. In fact, in some segments, even rising. So far, through October 2025, the $1M+ segment represents almost 17% of total sales. This is inline with the historical average of 15-20%. But, when an economy starts to decline and this segment holds its own, we take notice.

This is where we see the 2nd half of the unit sales gain in 2026. Homes above $1M look more attractive in a slightly softer market. Are you a “move up buyer”? This is someone who bought their initial home and now has a larger family, better income. Sure, you can’t sell your current home for as much as you once could. But, you can buy a home at $1 million that two years ago was $1.2M. A 10% market decline on your existing $800K home ($80K) is less than 10% decline on your new $1.2M home ($120,000).

Government policies could be part of the reason

These gains could be a result of the Sept 2024 announcement where the Government announced new rules. Traditionally you needed to have 20% downpayment on any house over $1M. Depending on your financial situation, you may not have this much equity or liquid funds for a minimum $200,000 downpayment. Naturally, this caused $1M to be a threshold for many for affordability. As of December 15th, 2024 this 20% minimum bar is now raised to purchases of $1.5M.

It would seem to us that both the entry level and higher end segments may see gains in 2026. Everything else in the middle we would anticipate to remain the same in terms of units sold.

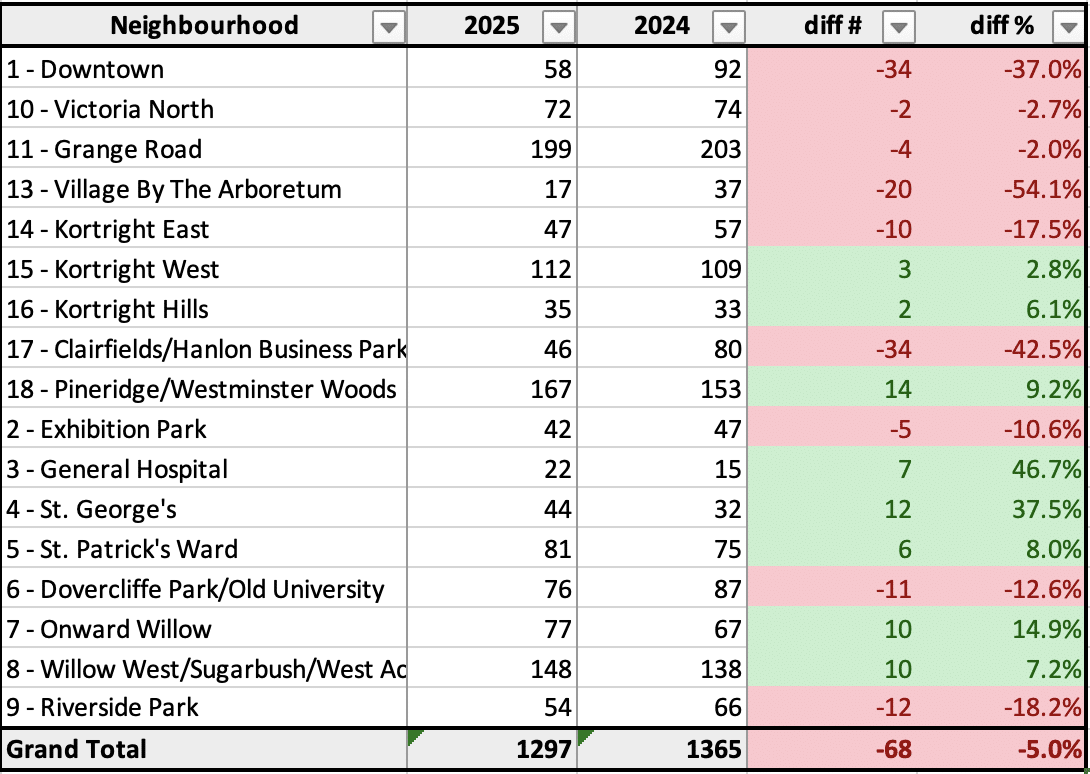

Neighbourhood strengths:

We recently spoke about in one of our recent Youtube videos on Guelph neighbourhoods. There are some clear trends that are happening. A few surprising, a few not so much.

In this chart, we show all the unit sales of neighbourhoods until Octo

This is a snapshot in time, but we anticipate a few areas will rebound in 2026:

Village by the Arboretum

This popular 55+ community has an average of 30 houses to sell every year over the past 5 years. It appears 2025 is an anomoly and we would anticipate back to the trend of 30 in 2026. Additionally, 2024 was a record high sales volume for a full year (44) sales. So, comparing year over year to a record year will be tough.

Over the last few years, we have been very active in the the VBA. This land lease community has a unique and nuances you won’t find elsewhere. It’s important you work with realtors® who understand the nuances of the Village by the Arboretum.

West Guelph

There is still great value in some areas of Guelph for those who are looking for housing under $500/sf.

West Guelph offers something for every buyer. This includes mature 70’s and 80’s homes, entry level condos and townhomes. Additionally you’ll find new homes, detached, semi and condo options ranging from $350K- $2M. Additionally, infrastructure upgrades west of Guelph to KW are happening. If you’re considering getting into the market and trading up, give us a call to discuss options for West Guelph

South Guelph

Many homeowners in the GTA who bought in 2020/2021 are facing mortgage renewals in 2025/26/27. As a result, they may decide to maintain their home size by selling in the GTA. As a result, they’re buying something similar- and cheaper- a little further west into Guelph.

South Guelph offers quick access to the Hanlon Expressway/ 401 and like West Guelph, has a variety of options. South Guelph provides a similar feel to Mississauga and Milton at a cheaper price. You can find entry level condos to multi-million dollar homes.

4. Extra: Student rental properties

For many years and continuing into 2026, student housing continues to be a problem in Guelph. Anyone who had a student going to the UofG this or last year noticed one thing. It’s a mad scramble to find housing.

As a result of this, parents continue to call us to purchase a home/ condo for their students. Many of these purchases have been condos or townhouses in student areas. This includes Gordon St, South Guelph, around the University, parts of the Ward. This further props up the sales of the south Guelph areas. In particular, Kortright West.

We have written a blog that outlines all the considerations for those parents wanting to purchase student housing in Guelph.

Get in touch for more 2026 Guelph real estate predictions

Want more regular info on the Guelph real estate market? You may also find our Youtube channel and Guelph real estate podcast helpful!

We’re Guelph Realtors and would be happy to add you to our mailing list or chat further!