It’s that time of year again, where we review prior year predictions (2023) while providing our 2024 Guelph real estate predictions!

2023 was a much tamer year than 2022 for a variety of reasons. The market chugged along in Guelph real estate with the peak hitting around May, before drifting off in the summer and fall. As of November, the market is very slow.

Into September which is traditionally a busier month, we saw increased inventory. This together with a complete absence of buyers is now putting buyers back in the drivers seat as we end the year. Inventory is well over 300 houses for sale in Guelph. Very few are selling over the asking price and conditions are back in full force.

By late November and into December 2023, both buyers and sellers had fatigue. Buyers decided to sit on the sidelines of the Guelph housing market, while frustrated sellers just cancelled their listings. The result: a multi-year low number of sales (units) in December 2023. At the end of the year, Guelph was down to about 150 listings in total- an almost 50% decline from the peak in September.

As of early January 2024, we haven’t seen the surge in listings we expected. At this point, we are just below 200 listings and regular January sales volume.

2024 Guelph real estate predictions

Of course, making our 2024 Guelph real estate predictions on a full year worth of real estate is a big task. In fact, if we knew for certain we’d probably be retired already!

Our team watches data on a weekly basis, so we start to see trends in real time. It was what allowed us to predict the rise in bungalows for sale in Guelph in the older neighbourhoods as downsizers and investors moved into Guelph.

So, based on what see today, here’s three areas that we will look at to provide insight into 2024:

1. Market performance +3-5% on average price

2023 was a surprising year, as the first half and second half were polar opposites of each other. When we outlined our 2023 Guelph real estate predictions, estimated a much softer 1st half vs 2022. However the reality was that the softer half has been the 2nd half of 2023. We anticipated full year average price in 2023 Guelph real estate predictions to see a 3-5% decline in the average price of a home. As of mid November, that decline is -9.2%.

For 2024, we anticipate a much busier spring market than 2023. “Busier” doesn’t necessarily mean rising prices. We anticipate that at some point before June 30th, 2024 there will be an interest rate decrease. And, those buyers who have been on the sidelines waiting, will jump in. Couple this with an already strong spring market and we could see Spring 2021 all over again.

We anticipate 2024 to behave more of like 2019, where sales volume was much more levelled and predictable. Overall, we anticipate a 3-5% increase in average price for 2024. As interest rate increases slow down, consumers accept the state of the market.

At the same time, we anticipate a 3-5% increase in number of houses sold on the conservative side- perhaps even greater. 2023 underperformed the market sales vs the previous 3 years due to low inventory in Q3/4. For 2024 we anticipate this will pick up to annual levels again.

2. Detached homes will gain share back

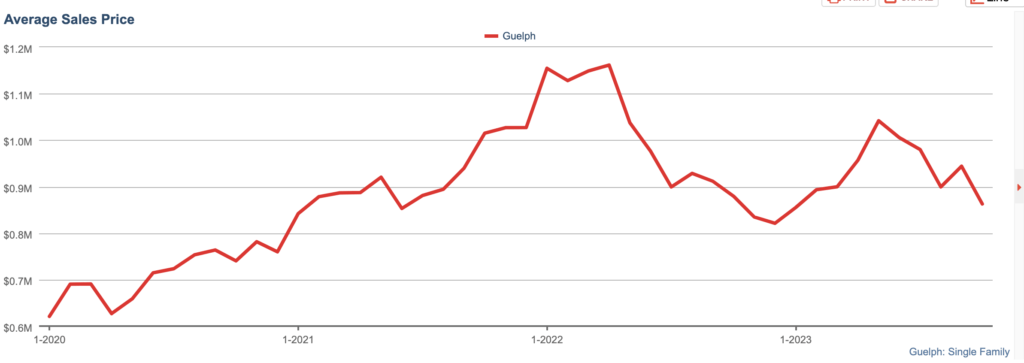

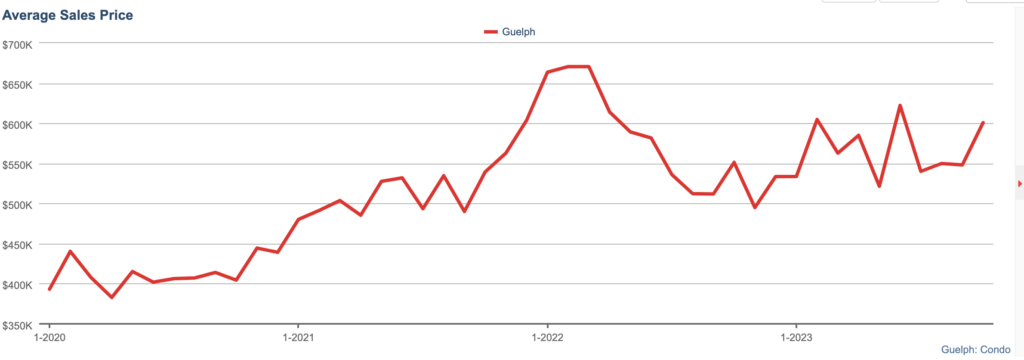

Take a look at the two charts below. The first is the average price of a detached home in Guelph since the peak of the market. The second is the average price of a condo in Guelph since the peak of the market.

Detached homes: -25.7%

Condos: -10.4%

Overall Guelph market (all homes): -23%

This means that as the market has corrected, detached homes have been the format that have really taken a beating. This is because the gap between detached homes and condos was too large. Now, as prices start to come down on detached homes, we’ll see buyers who were considering a condo now move back towards detached homes.

Buyers who want a detached may now be considering a $750,000 bungalow vs a $599,000 condo with condo fees to be equal. And in most cases, they’ll chose the non-condo fee version of a detached home. So, for our 2024 Guelph real estate prediction: detached homes will rise.

Of course, there are definitely benefits to owning a condo. Lawn maintenance and upkeep is not for everyone and condos are perfect for those people. However, first time buyers often have desire to own a detached home over a condo and these declining prices may help them.

Detached homes in Guelph: -25.7% vs peak of March 2022

Condos in Guelph: -10.4% vs peak of March 2022

3. More GTA buyers move into Guelph

On any given month, GTA/out of town real estate agents represent 25-30% of volume in Guelph. In September and October 2023 we noticed a significant bump in this: ranging between 40-55% of transactions were made by out of town agents.

This would imply that buyers are going further out of the GTA to get a home that fits within their budget and mortgage approval. In particular, we’re noticing a larger number of Brampton, Mississauga and City of Toronto agents coming into Guelph to help buyers- and noticeably, first time buyers.

These agents and buyers were a catalyst to the increased sales volume in 2021 and this could light a fire under Guelph volume in the spring. Especially if we see a Bank of Canada rate decrease.

4. Bonus: Student rental properties in Guelph

Anyone who had a student going to the University of Guelph this year noticed one thing: it’s a mad scramble to find housing. Our 2024 Guelph real estate predictions include an impact from students.

The University of Guelph openly over admitted students in 2022-23 and for the first time didn’t have enough residence space for it’s students. This caused students to flood into the residential rentals in Guelph, driving up prices. Students had to settle for less than ideal prices in less than ideal proximity to the University, just to get a home.

As a result of this, many parents decided to purchase a home/ condo for their students. Taking extra care to ensure they still had a university experience, many of these purchases have been condos or townhouses in student areas (Gordon St, around the University, parts of the Ward).

Now, parents of students are competing with first time buyers, investors and downsizers to find condo spaces.

Our team has helped a number of parents find homes for their children. If you’re looking to purchase a student rental in Guelph, give us a call. We can help you!

Get in touch for more 2024 Guelph real estate predictions

If you find our 2024 Guelph real estate predictions useful, get in touch! We’re Guelph Realtors and would be happy to add you to our mailing list or chat further. Our team at Keller Williams Home Group Realty can help you buy or sell a home in Guelph.